An Innovator and Leader in the Asset Liquidation Field

Since its beginning in the early 1950’s, when brothers David, Henry, Irving and Saul Rabin returned to San Francisco after the Korean War to sell war surplus, Rabin has been an innovator in the asset liquidation field. More than sixty years later and still led by the Rabin family, the company has grown from a small upstart to into an industry leader, with the ability hold auctions across multiple continents. For decades, Rabin has been the auctioneer of choice for some of the world’s favorite brands, as well as smaller enterprises. In the late 1990’s, Rabin launched Rabin Management Company (RMC), enabling the company to acquire and manage industrial and commercial real estate across the United States.

1950's

Early

50’s

After serving in WWII, brothers David, Henry, and Saul Rabin returned home to San Francisco and started selling army surplus purchased on a weekly basis from the Alameda naval yard.

Mid

50’s

As business flourished, Bay Bridge Sales was formed and the three brothers branched out into bankruptcy sales, liquidating everything from hardware to Chinese art goods.

late

50’s

Simultaneously, the remaining brothers formed Henry Rabin Company (HERCO), which was focused on liquidations.

1960's

63

After returning home from the Korean War, younger brother Irv started the Irving Rabin Auction Company (IRCO) and landed the Natomas Company auction, a public traded gold mining firm famous for extracting over $100,000,000 of gold by hydraulic mining.

65

Two years after Natomas, IRCO auctioned another gold mining company — Golden Cycle Mining. A buyer who a purchased several large steel tanks from the auction showed up a couple years later at another IRCO sale, to thank Irv for the jar of golden nuggets he had extracted from the muck left in the tanks.

1970's

72

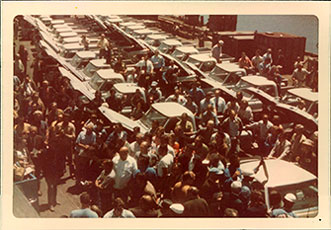

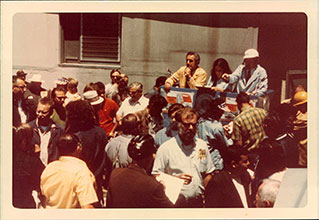

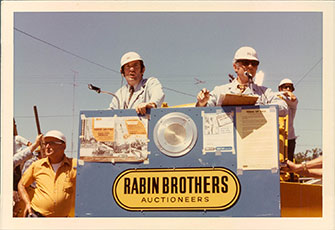

After nearly two decades apart, and expanding into projects outside of California, the four Rabin brothers joined forces and formed Rabin Brothers Auctioneers in 1972.

75

How do you auction off a Railway Express with 200+ depots? In 1975, Rabin did it by staging and assembling 26 auctions in different locations across the U.S.

76

In 1976, Rabin bought Rheingold & Schaefer Brewing Companies, a large brewery on a couple of acres of prime real estate under the Brooklyn Bridge. The equipment was auctioned and the property was eventually sold, but this marked the beginning of Rabin’s renown as an expert in food service auctions.

1980's

Mid

80’s

Moving from beer to wine, Rabin auctioned off 550 acres of grapes, dozens of tasting rooms, and retail stores across California when it took on Brookside Winery as a client.

87

Two big firsts happened in 1987–Rabin’s first airline auction of Braniff Airways and its introduction of theater-style auctions to the industry. For the first time, buyers were able to view and bid on items while comfortably seated in a theater-like setting (in this case, out of the blazing sun). Soon, all auction companies adopted this method.

Late

80’s

In the late 1980s, Rabin conducted one of its largest auctions to date – a $20 million deal with Interstate Trucking. More than 8,000 trucks in 30 different terminals were auctioned across the U.S. in a six-month time period.

1990's

92

Business was flying high in 1992 when McDonnell Douglas sought Rabin’s help in auctioning off their airplane assembly facility located in Irvine, CA.

96

Firmly cementing its position as an expert in the food services industry, Rabin embarks on a long-standing relationship with Nestle Foods. Rabin went on to handle the Nestle factory closings in the U.K., U.S. and Mexico.

95

The British Invasion! Rabin opens an office in the United Kingdom in 1995.

96-97

As sugar was traded for Hawaii’s new cash crop, tourism, Rabin was there to help with the transition. Rabin auctioned sugar mill plantations all across Hawaii, including C&H, Amfac, and Castle and Cooke (Dole).

Late

90’s

Other notable auctions and sales in the 1990s include all of the furnishing for the historic Sand Hotel in Las Vegas, Nevada; vaults and furniture for 200 Wells Fargo banking branches; car-making lines for Nissan Automotive; bakery lines for Granny Goose; cosmetic manufacturing equipment for Yardley of London; and plastics injection model production facility sale for Fisher-Price and Mattel.

98

Riding the Internet wave. Rabin conducts its first Internet auction.

99

Rabin auctions off a bit of history when it offers the fixtures and furniture from the landmark Clift Hotel in San Francisco, CA.

2000's

00

When American retailer Montgomery Ward went into bankruptcy after 128 years of business, Rabin was called in to liquidate the assets.

03

Who says you can’t buy dreams? Rabin auctioned assets from the U.S. Space Camp, NASA Ames Research Center in 2003. Rabin also expands to Asia-Pacific with liquidation and auction of the Kraft chewing gum factory in China.

04

2004 was a busy year for Rabin. We handled the sale of multiple food and cosmetic factories for Colgate and Proctor & Gamble in UK, Mexico and Argentina. We sold $30 million worth of pipe-laying equipment for Marine Pipeline and Equipment in Canada. And back in the UK, we handled auctions for Nestle Purina and Clairol Cosmetics.

![]()

05

In 2005, Rabin expanded its operations into the Middle East when it auctioned off dairy processing equipment for Tnuva Dairies —Isreal’s largest food maker. Later that year, Rabin secured buyers in the Middle East to take on all of Winona Medical in Indianapolis, IN, which included a fully equipped hospital.

![]()

06

In what has been our largest auction to date, Rabin sold more than 1,000 lots of underground cable-laying and construction equipment, including trucks, trailers, trenchers and backhoes, for Orius Communications. The auction, which took place over five days, was held in four cities across the nation. Closer to home, Rabin saw high bidder turnout for the auction of Mother’s Cookie’s assets after the bakery closed up shop in Oakland, CA later that year.

![]()

07

Rabin has had a long relationship with Scandinavian-based Leaf, one of the largest confectionary companies in Europe. In 2007, Rabin handled the sale of a Leaf plant in Turku, Finland, including 450 lots of equipment from Finland, Italy, Russia, UK, France, Denmark and Sweden.

08

2008 was the year of the food-processing auction for Rabin. We handled auctions for the companies that make some of America’s favorite foods—from chocolate to cereal, buns to biscuits—including Sara Lee, Hershey, General Mills, Nestle, Kellogg’s, Texas Signature Foods, Flowers Bakery, Burtons Biscuit and others.

09

In 2009, Rabin continued its run of food processing auctions with a sale of assets for Kraft Canada. Pharmaceuticals were also big this year as we took on a $50 million facility for GlaxoSmithKline in Puerto Rico, selling multiple lots of new and used equipment through auction.

2010's

10

Rabin partnered with multiple auction groups to conduct a massive auction of assets for Chrysler Automotive, including automotive machining centers, test and lab equipment, fabricating machinery, cranes and much more.

11

2011 was another busy year for Rabin with auctions spanning food processing, cosmetics, paper mills and window manufacturing. From the iconic brands Heinz, Sara Lee and Wonder Bread to more utilitarian brands Blue Heron Paper, Nivea and Milgard Windows, Rabin handled $28 million in auction assets this year.

12

Rabin was proud to have been selected to oversee the auction of nearly all of the assets of R.G. Steel Corporation, the fourth largest US maker of flat-rolled steel.

13

For more detailed information about our recent auctions and recent history, please see our past auctions section under the Buy page.

14

As soup production ceased at the massive Campbell’s Soup plant in Sacramento, Rabin orchestrated the massive sale of all the equipment. The 129-acre was highly improved to attract a diversity of tenants,and excess land at the site is now being parceled to sell for on-site development.

16

What do you do with hundreds of Yeti coolers and drink cups? Rabin faced that very question when we took on the sale for Enersafe. Our crack team of site set-up experts organized mountains of Yetis, along with all the rolling stock and safety equipment, resulting in a hugely successful auction.

The last half of 2016 saw our home office move from downtown San Francisco to our new home in the heart of Marin County.

17

Rabin purchased 473,478 square feet of real estate, machinery and equipment and vehicles located in 15 locations from Flowers Foods, in a single transaction. The real estate holdings included 6 properties, which Flowers had purchased in the 2013 Hostess Bankruptcy. After a short, intense negotiation, Rabin purchased all of the assets together, which assisted Flowers in removing the assets from their books before the end of the fiscal year. This was a rare opportunity to acquire significant real estate and equipment in a single transaction.

18

Necco, the oldest candy company in the US, ended an era when it shut the doors of its New England factory. Rabin not only has a long history of experience in the world of candy making equipment, but had previously auctioned equipment for the historic confectioner in the past. It was a monumental sale of not only machinery, but beloved brand portfolios.

19

And Beyond

For more detailed information about our latest auctions and recent history, please see our past auctions section under the Auction page.

One of the World’s Top Auction & Liquidation Companies

When you are ready to sell surplus industrial equipment or an entire business, Rabin is one of the few liquidation companies that can provide all the necessary resources. As an international family-held industrial auction and real estate investment company, our size and financial ability allow us to take on deals of any magnitude and complexity.

We are aware of the fact that companies can face different sets of challenges, which call for unique solutions. That is why Rabin has become a specialist in presenting clients with a customized approach for valuating, marketing, and selling industrial assets. Our team of seasoned auctioneers, appraisers, and project managers has the requisite experience to efficiently match assets for sale with qualified buyers. Using our extensive international database, we target buyers for both product type and geographic location.

We invite you to contact us for a free, private consultation. We are confident that the time you spend with us will empower your decisions. Rabin is headquartered in San Francisco with a European subsidiary office in Manchester, United Kingdom.