Oil Mires the Market

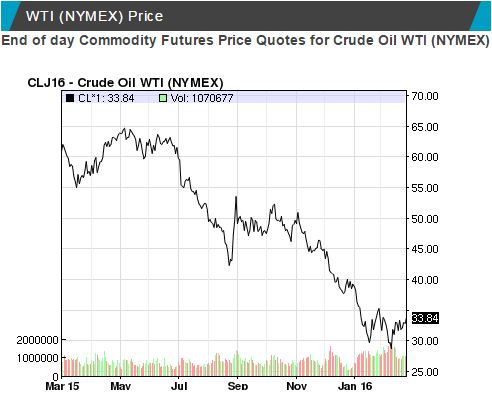

As we entered the new year, oil prices still saw no reprieve; in fact, less than one month into 2016, the price of crude was already down by 28 percent. While cheaper gasoline and fuels meant good news to consumers and a large number of companies, the drop also slammed the stock market and crowned 2016 with the unenviable title of having had the worst start to a year in history.

Normally, lower oil prices have either a positive or neutral effect on the economy since income is only transferred from oil producers to consumers; however, the recent plunge, in conjunction with the stalled Chinese economy, has investors concerned that global growth is slowing as many developing countries cut spending. What doesn’t help is that many banks made loans to energy companies seeking new places to drill back when oil prices were high, to the effect that the oil and gas industry has $500 billion of outstanding debt—debt some may struggle to repay as cash flow slows and the number of bankruptcies rise.

We may see oil bottom out even further. In the World Economic Forum that took place in January, BP chief Bob Dudley said that it was “not impossible” that oil prices might hit $10 a barrel, a low that has not been seen since 1986. However, he also asserts that such a low price is unsustainable in the long run and would soon rebound, predicting that the lowest would come sometime during the summer and that the second half of the year would see prices starting back in an upward trajectory.

We may see oil bottom out even further. In the World Economic Forum that took place in January, BP chief Bob Dudley said that it was “not impossible” that oil prices might hit $10 a barrel, a low that has not been seen since 1986. However, he also asserts that such a low price is unsustainable in the long run and would soon rebound, predicting that the lowest would come sometime during the summer and that the second half of the year would see prices starting back in an upward trajectory.

With the international sanction on Iran being removed, we can anticipate a massive glut of oil rushing into the already flooded market, a trend that was started by increased production from American shale producers and then exacerbated by OPEC consistently exceeding their production ceiling in an effort to maintain their market share and end the profitability of U.S. oil producers.

The good news? Everything will eventually balance itself. Commodities researchers, such as the London-based Capital Economics Ltd., think that a price of $60 a barrel will be the happy medium for both producers and consumers, and expect oil to work toward that equilibrium by the end of next year. Dudley, likewise, predicts that “towards the end of the year, [oil prices] could be into the $50s.”